Download Our Free Guide to Business Valuation for Shareholders’ Disputes

Disputes between shareholders can be all too common. However, if you’re in the position where you need to value a shared business, in order to quash the conflict, it’s important that you have an expert in your corner.

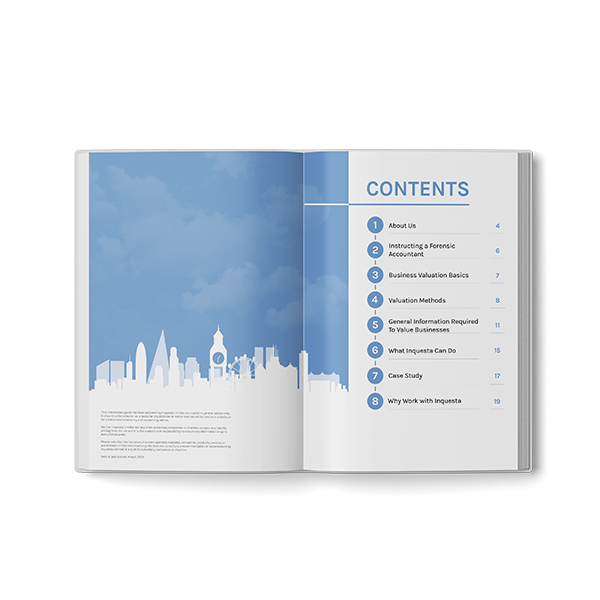

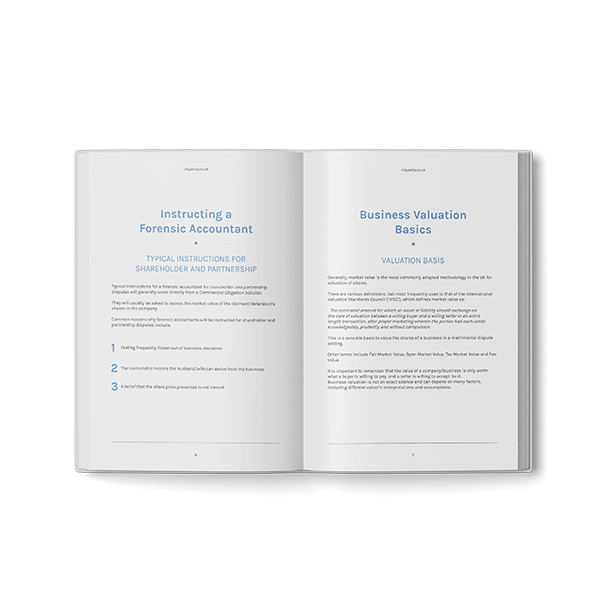

Business valuation for shareholders’ disputes can be a highly complex process. There are a variety of possible valuation methods, each with differing considerations. Our complementary guide goes into detail about the process of conducting a business valuation for shareholders’ disputes, to ensure that you’re able to provide an all-encompassing service for your client.

Download Now

About the Author

Rob Miller – Director of Forensic Accounting

A co-founder of Inquesta, Rob Miller is a chartered accountant, a member of the Institute of Chartered Accountants in England and Wales (ICAEW), and a Practising Member of The Academy of Experts.

With decades of experience in providing specialist forensic accounting services, Rob has been instructed to assist with numerous cases — such as financial investigations, criminal defence and confiscation proceedings, commercial and contractual disputes, valuation matters, and much more besides. He has acted on behalf of claimants, defendants, and as a single joint expert.