When cash flow dries up, debts spiral out of control, and creditors start demanding payment, company directors are forced to make critical decisions under immense pressure. In times like this, the terms insolvency and restructuring will almost inevitably come up.

While the two are related, they represent totally distinct paths a company can take when dealing with financial issues. Where insolvency can seem to be the end of the road, restructuring offers a potential lifeline, helping a company to regain some semblance of stability and avoid closure. But how do you know which route is best suited to you and your situation?

Understanding the core differences between corporate restructuring and insolvency can help you to make fully informed decisions about the future of your organisation.

In this blog, we’ll break down both concepts, to help you determine the most appropriate course of action for your company’s future.

What Does the Term Insolvency Mean?

The term ‘insolvency’ refers to the financial state when a company is not able to pay its financial obligations as they fall due, leading to arrears. Insolvency is generally seen as a clear sign of a business in financial distress that will need to take immediate action to address these obligations.

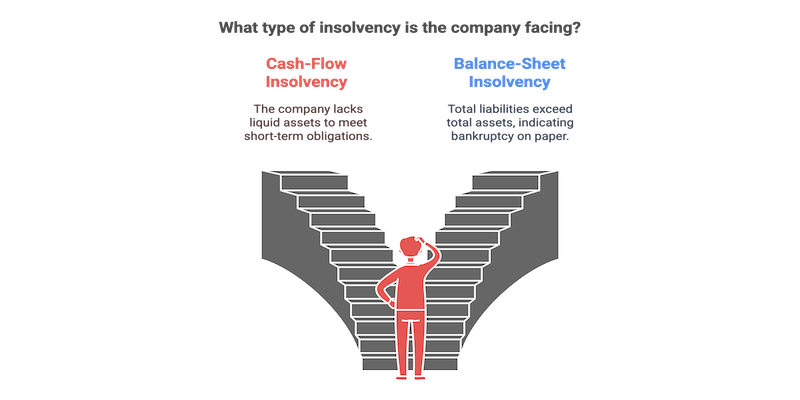

There are two main types of insolvency:

- Cash-Flow Insolvency: When a company doesn’t have the necessary liquid assets to meet short-term obligations and liabilities.

- Balance-Sheet Insolvency: When the business’s total liabilities outvalue its total assets — technically making the company bankrupt on paper.

What is Corporate Restructuring?

Restructuring describes the proactive measures utilised to improve a company’s finances and operational efficiency. Restructuring involves making changes to the company’s operations, finances, or structures. The purpose of corporate restructuring is to avoid insolvency and ensure long-term sustainability wherever possible.

Common methods of restructuring include:

- Debt Refinancing: Replacing existing debt with new debt under more favourable terms.

- Asset Sales: Selling non-core assets to raise funds and reduce liabilities.

- Cost Reduction: Streamlining operations, reducing overheads, or renegotiating supplier contracts.

- Equity Injection: Bringing in new investors or shareholders to provide capital.

Restructuring is often seen as a lifeline for businesses that are struggling but still have a viable path to recovery. It allows them to address financial challenges while continuing to operate and serve their customers.

Key Differences Between Insolvency and Restructuring

While insolvency and restructuring both address financial distress, they do so with different goals. Insolvency deals with an inability to pay debts, often resulting in liquidation or administration. Restructuring, however, focuses on reorganising finances to restore stability and avoid insolvency from happening. While insolvency can still result in closure, restructuring’s purpose is to keep the business operating and sustainable.

Here’s a quick comparison between the different purposes and outcomes of corporate restructuring and insolvency — this table can act as a handy tool to help you determine which approach best suits you and your situation.

| Insolvency | Restructuring | |

| Purpose | Address financial failures and unmanageable debt. | Improve financial health and stability for the present and future. |

| Timing | Often seen as a last resort for a struggling business. | Can be implemented earlier to prevent collapse. |

| Outcome | Often results in business closure | Aims to keep the business operational. |

| Methods | Liquidation, administration, Company Voluntary Arrangement (CVA). | Debt restructuring, operational changes, |

| Stakeholder Impact | Creditors may recover only a portion of what they’re owed. | Employees, creditors, and shareholders may benefit from continued operations. |

Are you questioning the difference between insolvency and restructuring and facing financial difficulties? If so, it’s highly recommended that you assess your situation carefully — to decide which is the most suitable course of action.

Can a Business Avoid Insolvency Through Restructuring?

When a business is dealing with financial difficulties, early intervention via the means of restructuring can prevent insolvency. A well-planned restructuring strategy can help immensely in improving cash flow, alleviating financial pressure, and streamlining operations — to set the company up for a brighter future.

Restructuring can help businesses in the following ways:

- Negotiating with Creditors: Formally renegotiating more affordable payment terms can help in easing cash flow pressures.

- Improving Cash Flow: By identifying areas of inefficiency and reducing costs, a business will be able to free up funds.

- Refinancing: Additional breathing room can be gained via new funding sources or by restructuring existing debt.

- Reorganise: By enhancing the efficiency of the business by streamlining processes and operations, a company can become better-equipped for long-term success.

It’s important to note that while restructuring can have a raft of potential benefits for a business, if it is delayed too long — you may find that insolvency has become the only viable option left. Being proactive is key.

What Happens if Restructuring Fails?

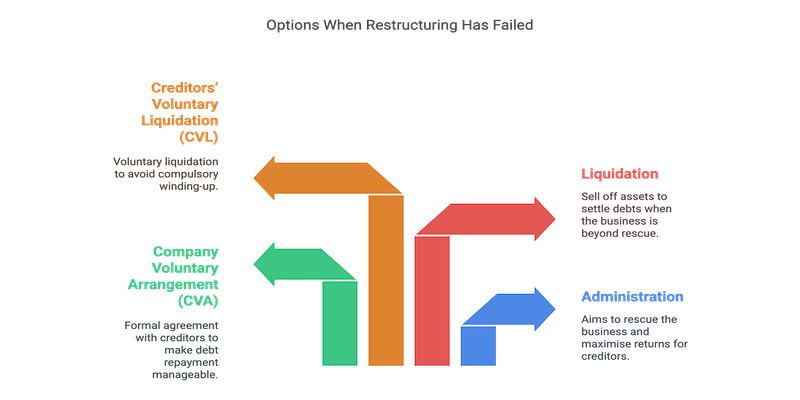

If restructuring efforts have not been successful, insolvency may become the only remaining option. This includes measures like administration and a Company Voluntary Arrangement (CVA) aimed at turning the difficult situation on its head, and liquidation if the business is beyond rescue.

The primary options for insolvent businesses if restructuring efforts have failed include:

- Administration: A licensed insolvency practitioner will take over control of the company. The aim of administration is to rescue the business while also providing maximum returns for creditors.

- Company Voluntary Arrangement (CVA): A CVA entails coming to a formal agreement with creditors to make debt repayment as affordable as possible.

- Liquidation: If the company is beyond rescue, liquidation may be required to sell off assets in order to settle outstanding debts.

- Creditors’ Voluntary Liquidation (CVL): If company directors feel that the business is no longer viable, they may voluntarily place it into liquidation to avoid a scenario where compulsory winding-up is required.

It’s important to remember that, even when in insolvency, a director still has legal duties they must uphold. It is recommended that you seek expert guidance if you wish to avoid potential personal liability or further punishment.

Seeking Professional Advice

Regardless of which is best suited to your situation, both insolvency and restructuring require careful handling. Seeking professional advice early into the process can make a crucial difference.

An experienced insolvency practitioner can assess the financial position of the business before advising on your available options, including corporate restructuring and insolvency.

They can also help directors to navigate the complex legal and financial obligations they will face when the pressure is ramping up.

Find Financial Stability with Inquesta

Insolvency and restructuring are two distinct approaches to addressing financial difficulties. Each has its own implications and outcomes. While insolvency is often viewed as a last resort, restructuring offers more proactive ways to turn a tough situation around.

If your business is struggling, delaying action will only make things worse. Whether you’re considering restructuring as a method of turning things around, or need to explore available insolvency options, seeking expert advice early can be the difference between survival and closure.

Our expert team of corporate restructuring and insolvency specialists is here to help you. We provide confidential advice, to guide you through the process and ensure you make the optimal decisions for you and your company’s future.

Don’t wait until it’s too late. Contact us today and take your first steps towards financial stability with Inquesta.