Significant news emerged this week of a letter from Rishi Sunak to the Office of Tax Simplification requesting a review of how capital gains are taxed ‘for both individual and smaller businesses’.

Despite being referred to as ‘standard practice’, concern is growing that the exercise may usher in radical changes as the government seeks to recover a £300 billion shortfall in public expenditure caused by the coronavirus crisis.

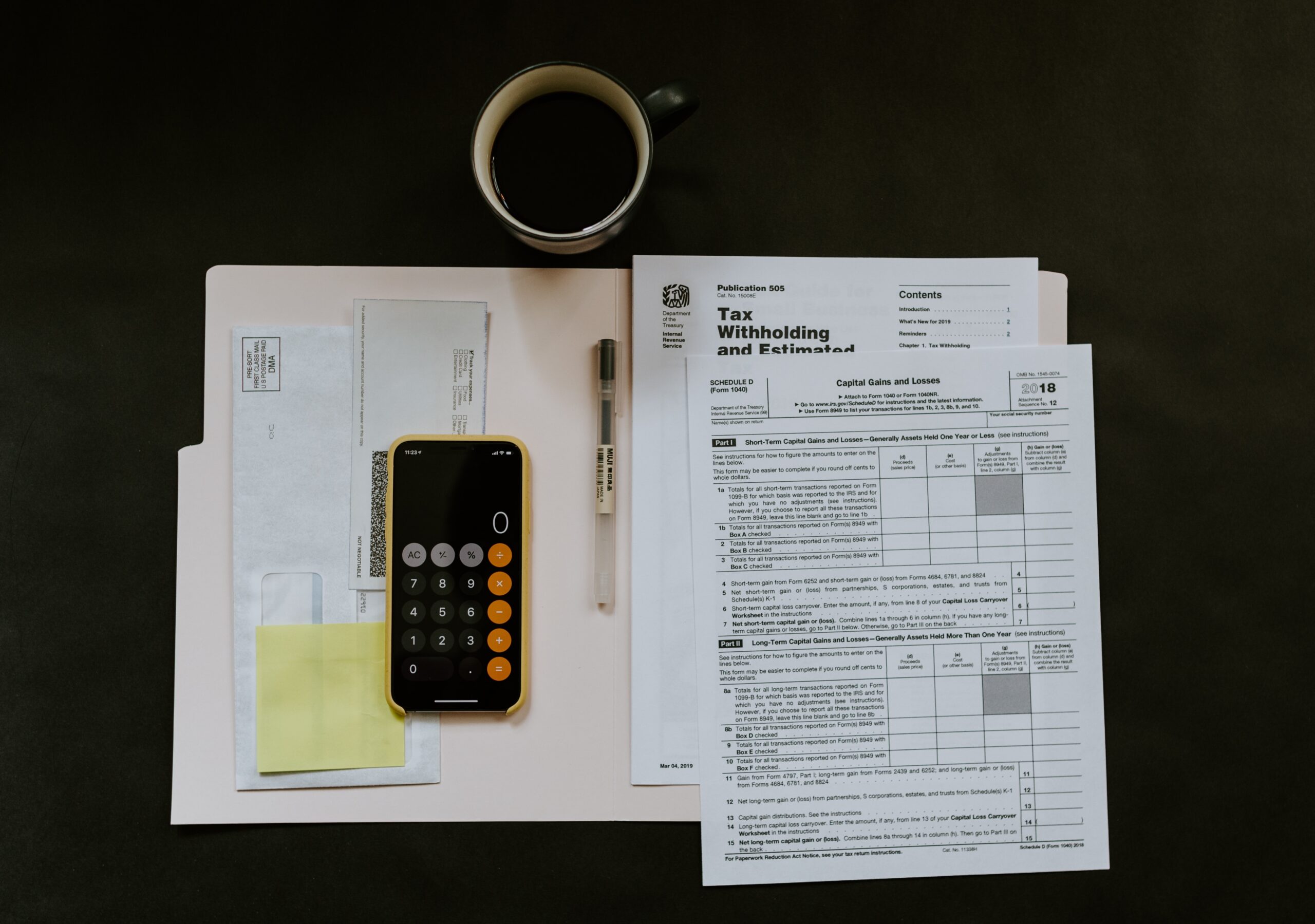

Capital Gains Tax (CGT) is a tax on the profit when you sell something that has increased in value. The only element that is taxed is the gain. It usually applies to gains made on shares and property, but is also applied to items as diverse as works of art.

The chancellor appears to have three options: reduce the allowances, raise the rates levied or levy it on other assets, such as private homes.

The last option is considered unthinkable, especially under a Conservative government. Private Residence Relief currently means that nobody pays CGT if they sell their home for more than they bought it. The thought of losing a significant proportion of the proceeds from moving home would likely stifle the housing market. It is particularly unthinkable given the stamp duty holiday introduced in the recent Summer Economic Update.

An increase in the main rate of CGT from 20%, which some already consider to be too low, would appear more likely.

Could the chancellor seek to increase the level to ensure parity with income tax rates of up to 45%? Experts described the review as bad news for investors, who may face an increase in tax on their investments.

The review also brings into the political debate the issue of a wealth tax which, whilst distasteful to the Conservative Party and its support base, is beginning to gain traction in wider circles.

Whatever happens, Rishi Sunak has shown himself capable of thinking outside of the box. Thinking back to the March Budget, many predicted that Sunak would abolish Entrepreneurs’ Relief outright. Instead, a creative compromise was reached in which the relief remained, subject to reform.

Whatever happens, the chancellor’s actions show that the first shots have been fired in the race to refill the public coffers in the post-Covid world. It is inevitable that taxpayers across the spectrum will feel the pain along the way.