Facing Business Debt Challenges? We’re Here to Help

If your company is struggling under the weight of debt, know that there’s a way forward. At Inquesta, we specialise in helping businesses explore tailored solutions to recover from debt and secure long-term financial stability. Whether you’re exploring options for restructuring, looking to negotiate with creditors, or are simply looking for expert advice, our business debt advice experts are here to guide you every step of the way.

Explore Tailored Business Debt Solutions

Debt doesn’t need to define your company’s future. With the right strategy in place, you can overcome any financial challenge and pave the way for recovery. At Inquesta, we offer a range of expert solutions designed to meet your unique needs and help you turn things around.

Administration

- Provides breathing space to restructure or sell the company.

- Ideal for companies facing insolvency with potential for recovery.

Company Voluntary Arrangement (CVA)

- Binding agreement with creditors to repay debt over time.

- Best for a viable business struggling with debts.

Partnership Voluntary Arrangement (PVA)

- Similar to CVA but specifically for partnerships.

- Perfect for partnerships looking to avoid liquidation.

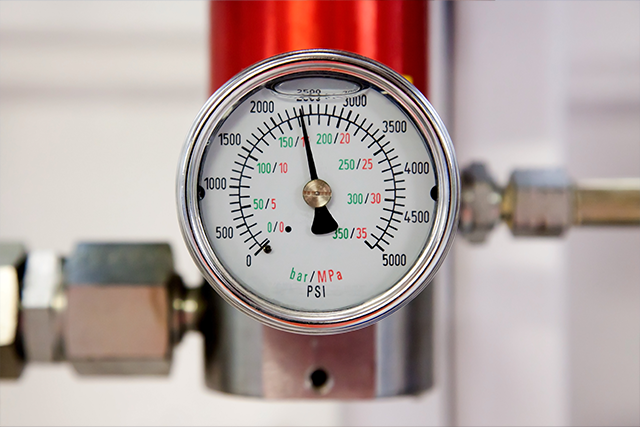

Receivership

- Appointed receiver takes control of the repayment of debts.

- Used when a company defaults on secured debt obligations.

Moratorium

- Temporary repayment freeze to explore recovery options.

- Can be initiated by directors or insolvency practitioners.

Business Restructuring

- Strategic overhaul to improve the business’s financial health.

- Perfect for companies looking to recover from debt and prepare for success.

Confused About the Best Path to Recover From Debt?

Navigating financial difficulties can be overwhelming, but you don’t have to do it alone. Inquesta’s team of debt specialists is here to assess your position and identify the root causes of debt, provide tailored business debt advice on the most effective recovery strategies, and help you implement solutions to secure your firm’s financial future.

Why Choose Inquesta’s Team of Business Debt Advice Specialists

At Inquesta, we combine decades of experience with a bespoke, personalised approach to business debt advice and solutions. Here’s why companies across the UK trust us to help when times are at their toughest:

- Tailored Strategies: Every company is unique, and so are their circumstances. We develop custom business solutions that align with your needs.

- Expert Guidance: Our team includes leading insolvency and financial experts with a proven track record.

- Comprehensive Support: From initial business debt advice to implementation, we’ll be with you every step of the way.

When your company is facing financial uncertainty, it’s vital to act quickly and decisively. Our expert team is here to guide you towards recovery.

Get in Touch

How Else Can We Support You?

In addition to providing business debt advice and tailored debt recovery solutions, we also offer a range of additional services to support business owners, directors, and individuals facing financial challenges. Whatever your situation, our expert team is here to help. Our range of services are:

Nationwide Business Debt Advice for Company Directors

Inquesta proudly supports businesses across the UK, offering expert advice and solutions tailored to your needs. So, if you’re looking to facilitate a turnaround of fortunes, our business debt advice and solutions service is ideal for you.

Whether you’re a small business owner or managing a large organisation, we’re here to help you overcome financial challenges and secure a brighter future.

Browse More Business Debt Advice Resources

Overdrawn Director’s Loan Account? Urgent Steps to Protect Your Assets

What may start as a short-term favour to yourself — borrowing money from your own company to cover a cash flow gap — can rapidly transform into a financial nightmare. An overdrawn director's loan account [...]

How to Solve Cash Flow Problems Before They Kill Your Business or Bankrupt You

Cash flow problems affect millions of UK businesses and individuals each year, creating significant stress and uncertainty that can often feel overwhelming. Whether you’re a business owner watching your unpaid invoices pile up or an [...]

How Can I Save My Business? Recovery Guide for Directors

Is your business struggling to stay afloat? Don’t worry, you’re not alone. Hundreds of thousands of UK business owners face serious financial challenges each year, particularly in today’s volatile economic climate. If you’re wondering “how [...]

The Impact of US Tariffs for Small Businesses: UK 2025 Guide

The joined up nature of our global economy today means that the ripple effect of policy changes by major economic powers can be felt across the globe, from Wall Street to Walsall. As a [...]

Business Debt Consolidation: Is It Right for Your Company?

Facing mounting debts can be overwhelming for any business owner. If your company is struggling with multiple loans, credit lines, or unpaid invoices, business debt consolidation could be a viable solution to regain financial stability [...]

Insolvency Risk Management for Directors

When your business is thriving, it’s understandable to feel unstoppable. But beneath the surface, unseen risks can quietly erode your financial stability. Before you know it, cash flow can dry up, creditors come knocking, and [...]