In the ever-shifting landscape of business, there are moments when even the most resilient companies will find themselves facing financial issues. When this pressure mounts and creditors are circling, what options remain for a business fighting to turn things around? A powerful and often overlooked lifeline — one that offers a temporary reprieve and a chance to regroup — is a business moratorium.

But what is a moratorium, and how exactly can it transform a company’s fate? In this blog, we’ll explore the intricacies of this process, its potential to save businesses, and the critical considerations every director must keep in mind.

What is a Moratorium?

A business moratorium is a legal mechanism that provides a company with temporary relief from creditor action. It’s designed to offer struggling businesses some much-needed breathing room, allowing them to assess their options for recovery. This period acts as a protective shield against the immediate threat of legal action from creditors, such as winding-up petitions or enforced asset seizures.

In the United Kingdom, moratoriums are often linked to ongoing insolvency proceedings. They won’t necessarily act as a signal of the end of a company, instead they serve as a strategic opportunity to explore restructuring options, negotiate with creditors, or even secure new financing to help stabilise the business.

The goal of a debt moratorium is relatively straightforward: it gives directors time to address financial challenges without looming threats from creditors.

Debt moratoriums became more prominent in the UK through the Corporate Insolvency and Governance Act 2020 (CIGA) which was introduced to help businesses facing financial difficulties, particularly in the wake of the COVID-19 pandemic.

How Does a Moratorium Work?

A moratorium works by temporarily halting creditor actions, giving a business time to stabilise its finances. Once approved, it usually lasts for 20 business days, with possible extensions. A licensed insolvency practitioner (known here as a monitor) will be appointed to oversee the process, ensuring the company works towards recovery while creditors are legally prevented from taking enforcement actions.

During the moratorium period:

- Creditors are Restricted From Taking Action: This includes enforcement, repossessing goods, or initiating insolvency proceedings.

- The Company Continues to Trade: Directors remain in control of the business. This allows them to focus on finding solutions to the company’s financial problems.

- Supplies are Protected: As part of the company moratorium, suppliers are also unable to halt the supply of key goods or services, such as utilities.

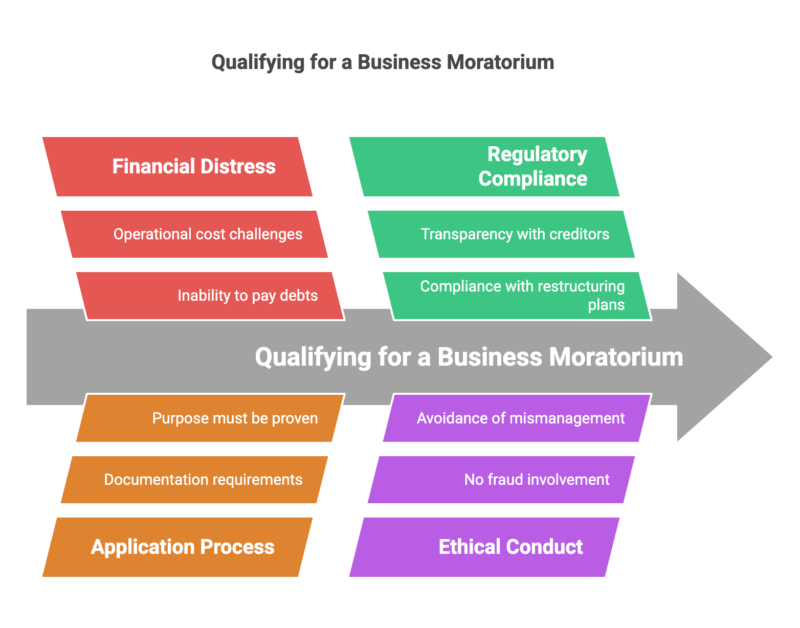

Business Moratorium Criteria: How to Qualify

To qualify for a moratorium, a business typically needs to meet certain criteria, which may vary depending on the jurisdiction and the specific type of moratorium (debt relief, bankruptcy protection, pandemic-related relief, etc.). Below are general points that often apply:

- Financial Distress: The business must demonstrate that it is unable to meet current financial obligations, such as paying debts, salaries, or operational costs.

- Application Process: The business, or its representatives, must formally apply. The application includes providing necessary documentation (financial statements, debt details, proof of hardship, etc.).

- Regulatory Compliance: The company must comply with specific regulatory requirements. This includes

- Maintaining transparency with creditors and stakeholders.

- Offering regular updates.

- Adhering to any proposed restructuring plans.

- Outline Purpose: The business must be able to demonstrate that the moratorium is necessary in order to prevent insolvency and protect jobs

- No Fraud or Mismanagement: The business must not have engaged in fraudulent activities or gross mismanagement that contributed to its financial difficulties.

How Can a Moratorium Save Your Business?

A debt moratorium can be a vital lifeline for a company teetering on the brink of insolvency. By providing some much-needed breathing space, a moratorium will enable directors to:

- Assess Financial Health: The moratorium period allows directors to take stock of their company’s finances without any unneeded distractions or creditor pressure.

- Explore Restructuring: With the pressure of creditor actions temporarily lifted, the company can negotiate with creditors, seek new investment, or implement a Company Voluntary Arrangement (CVA) to restructure debts.

- Creditor Negotiation: With legal action halted for a period, company directors have the opportunity to attempt to negotiate all-new payment terms or settlements to improve the businesses’ survival chances.

- Avoid Liquidation: Many companies are forced into liquidation simply because they lack the necessary time to plan accordingly. A moratorium offers directors the chance to explore any and all available options before deciding on the most appropriate next steps.

- Protect the Business: A successful moratorium will save jobs, protect supplier chains, and ensure that customers continue to receive expected goods/services. This can be vital in maintaining the company’s reputation going forward.

Is a Business Moratorium the Right Solution for You?

It’s important to remember that a company moratorium isn’t a one-size fits all solution. It is most suitable for businesses that are fundamentally viable but experiencing short-term financial issues. For instance, companies facing short-term problems with cash flow, delays in receiving high-value payments, or unexpected liabilities will particularly benefit from the protection a moratorium provides.

However, not all businesses will be eligible, or even suitable, for a moratorium. For example, companies with severe, long-standing issues surrounding insolvency, or those without a clear recovery strategy, may find that alternatives, such as voluntary liquidation or administration, are better suited.

Before you pursue a moratorium, you should consult with an insolvency professional who will be able to independently assess your financial situation, explore the options available to you, and guide you towards the best course of action.

Key Considerations to Keep in Mind

While a business moratorium offers valuable benefits, there are essential factors to consider:

- Eligibility: As covered above, not all businesses qualify for a moratorium. Certain financial and operational criteria must be met in order to gain approval.

- Costs: There are costs associated with appointing a monitor and managing the moratorium process. It’s important to weigh these costs against the possible benefits you would see as a result of the moratorium.

- Commitment to Recovery: A moratorium is not a passive solution. To reap the benefits, directors must be actively working on restructuring or recovery plans throughout the period.

- Creditor Relationships: While a moratorium will provide temporary relief, it’s vital that you maintain open and consistent communication with your creditors if you wish to facilitate future negotiations and a continued positive relationship post-moratorium.

Directors need to be aware that any misuse, or failure to act during the moratorium period can have significant legal and financial repercussions for those involved, including

- Personal liability for company debts due to negligence, fraud, or breach of fiduciary duties.

- Disqualification from holding director positions.

- Legal action for wrongful or fraudulent trading, or misconduct.

- Financial penalties for non-compliance with legal obligations.

- Reputational damage affecting future prospects.

- Invalidation of the moratorium, exposing the company to creditor actions.

- Criminal charges for fraud or intentional misconduct, potentially leading to imprisonment.

- Harm to employees, creditors, and stakeholders, leading to further legal or ethical consequences.

Securing Your Business’s Future: Why Expert Guidance is Key to a Successful Moratorium

“What is a moratorium?” is a common question asked by directors attempting to navigate financial turmoil. As discussed in this blog, a company moratorium is a vital tool to offer a much-needed pause for businesses to assess, restructure, and ultimately recover.

However, it’s not a one-size-fits-all solution to any financial issues, and careful consideration of eligibility, cost, and recovery plans is essential before embarking down this road. Directors must also be aware of the significant legal and financial repercussions of misuse or inaction during this period.

This is where the importance of working with a specialist insolvency practitioner that you can trust comes to the fore. At Inquesta, our team of specialists bring decades of experience, guiding businesses through the depths of financial struggles — including with the moratorium process.

We provide tailored solutions, ensuring compliance, protecting your interests, and doing our part to help you navigate the path to recovery with total confidence. When the stakes are high, you can trust Inquesta to be your partner in securing a brighter future for your business.

Don’t wait until it’s too late— contact us today to discuss how we can help you protect your business and achieve a successful turnaround.

Inquesta:

Helping Businesses Thrive, Even in Tough Times.

📞 [0800 093 4604] | 📧 [[email protected]] | 🌐 [https://inquesta.co.uk]

Disclaimer: This blog is for informational purposes only and does not constitute legal or financial advice. For tailored advice, please consult a qualified insolvency practitioner at the links above.