When your business is thriving, it’s understandable to feel unstoppable. But beneath the surface, unseen risks can quietly erode your financial stability. Before you know it, cash flow can dry up, creditors come knocking, and the threat of insolvency suddenly looms large. This isn’t just a hypothetical scenario — for many businesses each year that fail to prioritise insolvency risk management for directors, this is a reality.

But here’s the good news: these risks are just that, risks, it doesn’t have to spell the end. By recognising insolvency red flags early and implementing a robust risk management strategy, you can protect your business and your future at the same time. In this blog, we will explore some of the key warning signs, actionable steps to consider, and offer expert insights to help you in navigating these challenges with the utmost confidence and secure a brighter future for your company

What is Insolvency Risk?

Insolvency risk refers to the likelihood that a business will find itself unable to meet its financial obligations when they are due, potentially resulting in insolvency. Insolvency occurs when a business’s liabilities have exceeded its assets, or when it cannot pay off debts within a required timeframe.

Insolvency risk management for directors is vital as it will directly impact their ability to remain operational.

Insolvency risk can be caused by various factors, both internal and external, which can undermine a business’s financial stability, including:

- Improper Financial Management: Ineffective financial management is a leading cause of insolvency risk. Poor decisions surrounding budgeting, financial forecasting, and debt management, can put a company at risk.

- Poor Cash Control: Did you know that a company may be profitable on paper but still face insolvency if it regularly struggles with cash flow? Businesses that fail to properly manage and monitor their cash flow may find themselves unable to pay employees, service debts, or even keep up with operating costs.

- Market Changes: External factors like economic downturns or shifts in consumer preferences can increase insolvency risk. Any changes to the operational norm that reduce revenue or increase costs can push even stable companies into financial distress and further elevate the risk of insolvency.

- Unexpected Events: Unforeseen circumstances, such as extreme weather, lawsuits, or the sudden loss of a key customer/supplier can increase insolvency risk. While it may be difficult to predict such events, it’s important to create contingency plans to tackle this kind of sudden disruption.

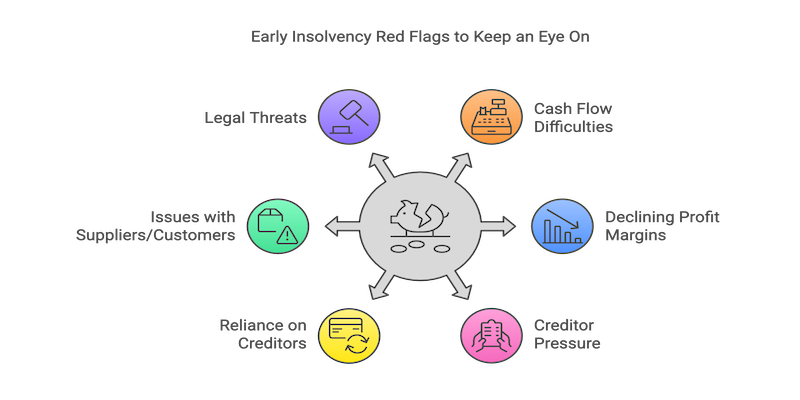

Early Insolvency Red Flags to Keep an Eye On

Recognising the early warning signs is the first step in effective insolvency risk management. There are a number of things to keep an eye out for, including issues with cash flow, declining profit margins, increased pressure from creditors,

over reliance on credit facilities, and more.

Some insolvency red flags directors should keep an eye out for include:

- Cash Flow Difficulties: If you find yourself struggling to pay your supplier, employees, and creditors in full and on time.

- Declining Profit Margins: Suffering from persistent losses, or a drop in revenue, that affects the businesses abilities to cover fixed costs.

- Creditor Pressure: Frequent late payment demands, statutory demands, or the submission of a winding up petition to the courts.

- Reliance on Creditors: When a company has a heavy over reliance on credit techniques, such as on loans, overdrafts, or deferred payments.

- Issues with Suppliers/Customers: Loss of key customers or suppliers in short-notice can be seen as a red flag.

- Legal Threats: If creditors are approaching you threatening compulsory liquidation, you should act immediately.

As a director, if any of these red flags are identified during your insolvency risk management process, it’s important that you take proactive steps to manage them.

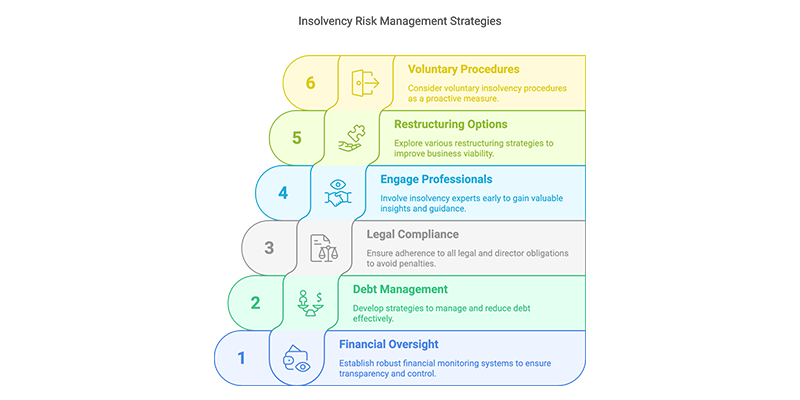

Key Strategies for Insolvency Risk Management

When it comes to effective insolvency risk management for directors there are a number of strategies you can implement. These range from implementing effective debt management to considering effective restructuring options. It’s important to consider consulting with an insolvency practitioner as early in the process as possible.

Plans to consider for proper insolvency risk management include:

1. Maintain Strong Financial Oversight

A director must ensure robust financial management practices are in place if they wish to prevent continued financial distress. Steps you can take include:

- Implement cash flow forecasting to predict future income and expenses, as well as identify any potential shortfalls.

- Thorough budgeting and cost control measures, including keeping track of company expenses and ensuring cash reserves can be preserved.

- Conduct financial reporting and analysis of financial statements in order to assess profitability and sustainability.

- Work closely with financial experts who can help in maintaining transparency and control over the businesses financial health, as well as those of directors involved.

2. Implement Effective Debt Management

Proper management of corporate debt is vital in the prevention of insolvency. Directors should:

- Renegotiate Payment Terms: By working closely with creditors and maintaining open and honest communications, you may be able to negotiate extended payment plans.

- Prioritise Payments: Some payments are more important than others. You should consider prioritising those that cannot wait, such as wages, rent, and essential supplier payments.

- Consider Alternative Financing Options: By exploring things like invoice financing, asset-based lending, or other commercial financing options, you may be able to bridge cash flow issues.

3. Comply with Director Duties and Legal Obligations

Directors have a number of fiduciary duties, as per the Companies Act 2006 and the Insolvency Act 1986. These responsibilities can come under significantly more scrutiny when insolvency becomes a legitimate possibility.

Key legal responsibilities a director must follow include:

- Avoiding Wrongful Trading: By continuing to operate and trade while being knowingly insolvent, you leave yourself open to personal liability.

- Prioritise Creditor Interests: When risks of insolvency arise, directors are expected to prioritise the interests of creditors over shareholders.

- Seek Assistance: Consulting with insolvency specialists at an early stage can help prevent potential legal repercussions arising.

4. Engage Insolvency Professionals Early

The earlier you seek professional insolvency advice when experiencing financial distress, the better your chances of recovery. Insolvency practitioners can provide:

- Legal Support: Help to directors, ensuring they can navigate and comply with the complexities of insolvency laws.

- Recovery and Restructuring Solutions: Assistance in refinancing and implementing cost-cutting or restructuring strategies to potentially stabilise the business.

- Formal Insolvency Options: If recovery is not viable, an insolvency practitioner will be able to support in Company Voluntary Arrangements (CVAs), administration, and other insolvency options.

5. Explore Business Restructuring Options

If insolvency seems imminent, restructuring could be the final available option. Some of the most common restructuring strategies you can consider implementing include:

- Operational Restructure: By streamlining operations you can both cut costs and improve efficiency.

- Financial Restructuring: Renegotiating terms of debts or securing alternative funding.

- Mergers and Acquisitions: By partnering with another business or an investor, you can strengthen financial stability.

- Divestment: The sale of underperforming assets or non-essential divisions of the business can raise essential funds to use elsewhere.

6. Consider Voluntary Insolvency Procedures

If recovery is categorically unachievable, voluntary insolvency can help in mitigating potential risks while protecting directors from liabilities.

Available options include:

- Administration: Placing the business under the control of a third-party administrator who will oversee restructuring or selling the business altogether in order to repay debt.

- Company Voluntary Arrangement: A CVA is a legally binding agreement with a creditor to repay company debts over time while being afforded the opportunity to continue trading.

- Creditors’ Voluntary Liquidation (CVL): CVLs are a formal process of liquidation where directors are able to voluntarily wind up the company.

Each option has different implications, so professional insolvency advice is essential before proceeding.

Consequences of Failing to Manage Insolvency Risks

Insolvency risk management for directors is a critical responsibility, as it involves identifying and mitigating against potential threats to a company’s financial stability. When a director fails to effectively manage these risks, they not only jeopardise the company, but also expose themselves to potentially severe personal and professional consequences.

These repercussions will vary from case-to-case, but can include legal penalties, financial liabilities, and long-term damage to both personal and business reputation which can come with its own consequences.

The primary consequences of failing to manage insolvency risks include:

- Director Disqualification: Any director found guilty of either wrongful or fraudulent trading can find themselves disqualified from serving as director of a limited company for up to 15 years.

- Personal Liability: If a director is found to have acted inappropriately or irresponsibly in any way, they could find themselves held personally liable for company debts. Actions that could result in personal liability include:

- Trading when (knowingly) insolvent

- Misusing company funds

- Acting against the interests of creditors

- Breaching fiduciary duties

- Keeping improper financial records

- Offering preferential treatment for some creditors over others

- Fraudulent trading

- Damaged Reputation: An insolvency in the past can significantly harm a director’s credibility. This can make it incredibly tough to secure business opportunities in the future.

- Legal Issues: It is possible that aggrieved creditors may look to pursue legal claims against company directors for any breaches of fiduciary duties or for acting inappropriately.

Proactive Insolvency Risk Management is Essential

While navigating insolvency risk management for directors isn’t an easy process, it is absolutely vital. From keeping a close eye out for insolvency red flags to seeking expert advice as soon as possible,.the steps you take now can be the difference between keeping your company afloat and your reputation intact and facing severe professional, personal, and legal consequences for years to come.

At Inquesta, we understand how overwhelming the risk of insolvency can feel, and we’re here to help you tackle it head-on. Our team of experts offer tailored solutions, whether you’re looking to restructure, recover, or explore your insolvency options, we are here to help. With our support, you can stay on top of compliance, protect your business, and keep your reputation intact.

It’s vital that you don’t wait until it’s too late — take charge of your business’s financial health today. Contact Inquesta to find out more about how we can assist you.