In the world of business, having the right structure for you and your operation is vital. It can have a huge knock-on effect on the ultimate success and viability of your business. Selecting the wrong operational structure could even lead to your company failing.

The advantages and disadvantages of limited liability will ensure that the decision to implement this concept, one that could shape your operation for years to come, must be a measured one.

Whether you’re an entrepreneur looking for a new challenge or an experienced business owner complimenting a restructuring, it’s important to have a strong idea regarding limited liability, a fundamental legal concept.

What Does Limited Liability Mean For a Business?

Limited liability refers to the legal concept that states that a company is a separate legal entity to its owner/owners. This safeguards the owner’s personal assets from the debts and liabilities of the company. Limited liability means that the company as ‘an individual’ can own assets and be responsible for its own financial issues.

Limited liability is most important for corporations or Limited Liability Companies (LLCs).

The purpose of limited liability is to promote entrepreneurship, investment, and overall economic growth. If it didn’t exist, businesses would likely find it near-impossible to attract investment from anybody who didn’t have an emotional or personal link to the operation.

Additionally, investors and owners will often have large sums of money tied up in their businesses. Without limited liability, these stakeholders would likely be faced with a ‘double jeopardy’ situation. This is because these owners and directors could easily find themselves embroiled in serious financial difficulties if they are personally liable for company debts following insolvency AFTER sinking all their funds into it.

Ultimately, limited liability is there to strike an even balance between encouraging prospective owners and directors to invest and entrepreneurial-ism, and protecting their interests as well as company creditors.

The trade off with limited liability is that in return for this protection, business owners have certain legal responsibilities that they are required to comply with in order to retain this financial ‘safety’.

What is the Difference Between Limited and Unlimited Liability?

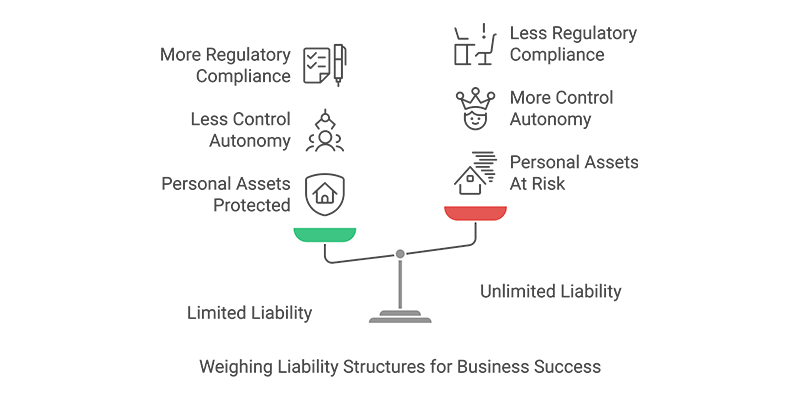

While the purpose of limited liability is to protect business owners by ensuring that their personal assets are not at risk if the company faces financial trouble, unlimited liability offers no such protection. Limited liability vs unlimited liability is an important distinction for a company owner or entrepreneur to know.

Typically applying to sole traders and general partnerships, unlimited liability means that the owners will be expected to be personally responsible for all business debts and legal obligations. This means that if the business cannot pay creditors, the owner’s personal assets can be seized in order to cover the outstanding debt. Assets that could be seized include:

- Personal Savings and Bank Accounts

- Real Estate

- Vehicles

- Investments

- High-Value Belongings

- Retirement Accounts

- Business Assets

- Future Earnings

Unlimited liability is, therefore, seen as being much riskier for an owner. This is particularly true in industries where financial uncertainty is to be expected, such as construction, retail, and hospitality.

The reason some business owners will accept unlimited liability, despite the significant risk attached, boils down to control over their company. It allows them to maintain complete autonomy over their enterprise while reducing the burden of regulatory compliance.

The act of choosing between limited liability vs unlimited liability is a crucial decision that will impact your financial security, legal obligations, and business success. For entrepreneurs, it’s imperative that you weigh the risk very carefully before deciding on the structure that best suits your needs.

What Are The Advantages of Limited Liability?

Limited liability offers a number of notable advantages for business owners and investors alike, making it popular when it comes to structuring a business. These advantages include but are not limited to

Protect Your Assets

The most obvious advantage of limited liability is also the core reason why it exists in the first place. As mentioned above, limited liability exists to stop creditors going directly for the owner’s personal assets (property, vehicles, bank accounts, investments, etc.)

This allows business owners and directors to make some calculated financial risks without fear of the potential repercussions it could bring upon their personal and home life. This breeds entrepreneurship and innovation.

Increased Investor Confidence

Put simply, investors are always going to be more interested in investing in a company with limited liability. This is because their potential financial exposure will be limited to only the amount that they actually invested.

This can make finding investment and outside funding significantly easier, potentially hugely beneficial to the future of the company.

Better Business Growth

A limited liability entity is able to more easily raise additional capital by way of issuing shares to shareholders.

This easier method of raising funds is ideal should you ever wish to expand.

Tax Benefits

Limited liability companies (LLCs) offer flexibility in taxation. In some jurisdictions, LLCs can choose to be taxed as a partnership, avoiding the double taxation that can occur with corporations.

What Are The Disadvantages of Limited Liability?

While limited liability does offer benefits, it’s important to also be aware of the potential drawbacks. This concept can bring additional costs, add often unwanted complexities and complications to the business, or it could lead to you losing direct control of your own company.

For a company owner, it’s vital to compare both the advantages and disadvantages of limited liability before settling on the ideal structure. You should try to seek what works best for your specific situation.

Here is just a selection of the possible disadvantages of limited liability:

Additional Corporate Complexities

The act of establishing a business with a limited liability structure can often be more complex than other, simpler structures. A corporation or LLC can also require more administrative work such as additional paperwork, necessary meetings, as well as a number of extra regulations that must be met.

Various Extra Costs

The process of creating and maintaining your limited liability company will often involve a number of extra costs on top of your usual operating costs. This includes, but may not be limited to:

- Legal fees

- Filing fees

- Compliance expenses

- Additional taxation (double taxation for corporations)

- Dividend taxation

While many of these costs may be present regardless of your business’ structure, they will often be higher for a limited liability entity.

Potential for Control to be Limited

If your business is operating with a large number of shareholders, the decision-making could become much more difficult.

The more people offering their input in the process, the more conflicts that can arise, and the more difficulties you can have coming to a consensus.

This increased competition to make decisions can, over time, result in long-term decision-makers losing some of their direct control.

Limited Liability Companies (LLCs) vs. Limited Companies (Ltd) in the UK

While many in the UK may search for information about Limited Liability Companies (LLCs), it’s important to note that they are not a UK business structure.The UK-equivalent business types are Private Limited Companies (Ltd) and Limited Liability Partnerships (LLP). Understanding the key structural differences between is essential, especially when considering the implications for taxation, liability, and insolvency.

Key Differences Between LLCs and UK Limited Companies

Legal Structure:

- LLCs (US): An LLC provides flexible management structures, with members typically managing the company. This allows for less formal operational requirements than corporations.

- UK Limited Companies (Ltd): A UK Ltd company must have at least one director and shareholders. The directors are legally responsible for managing the company on behalf of the shareholders.

Taxation:

- LLCs (US): In the US, LLCs are often taxed as pass-through entities, meaning profits are passed to the members and taxed on their personal returns, avoiding corporate-level taxation.

- UK Limited Companies (Ltd): In contrast, UK Ltd companies are subject to corporation tax on their profits. Shareholders may then pay personal tax on any dividends they receive, leading to a different tax structure.

Ownership & Liability:

- LLCs (US): LLC members have limited liability, meaning they are not personally liable for the company’s debts, except in cases of fraud or illegal activities.

- UK Limited Companies (Ltd): UK Ltd company shareholders enjoy limited liability protection as well, but directors can face personal liability in cases of wrongful or fraudulent trading during insolvency.

If you’re based in the UK and searching for information about LLCs, you’re likely looking for guidance on company structures. In the UK, setting up a Ltd company or an LLP would be the appropriate choice. It’s essential to understand the differences to avoid confusion about tax obligations, management responsibilities, and legal protections.

For businesses facing financial difficulties, knowing how these structures affect insolvency proceedings and taxation is key. Understanding the appropriate business structure can help you make informed decisions about liability, directorial responsibilities, and navigating potential insolvency processes.

Limited Company vs LLP: Which is Right For You?

Choosing between setting up a Limited Company vs LLP will depend on your needs. A Ltd is ideal for those seeking to raise capital while limiting personal liability, whereas an LLP is better suited for professionals like lawyers/accountants who wish to share management while benefitting from greater tax flexibility. Consider all the factors when deciding.

| Feature | Limited Company (Ltd) | Limited Liability Partnership (LLP) |

| Legal Structure | Incorporated business entity | Hybrid structure (partnership + company) |

| Liability | Limited liability for shareholders | Limited liability for partners |

| Ownership | Owned by shareholders | Owned by partners |

| Management | Managed by directors | Managed by designated members |

| Taxation | Corporation Tax on profits | Partners taxed individually (Income Tax) |

| Profit Distribution | Dividends to shareholders | Profits shared among partners |

| Compliance | File annual accounts with Companies House | File annual accounts with Companies House |

| Public Disclosure | Financial information publicly available | Financial information publicly available |

| Setup Costs | Moderate (registration fees, accounting) | Moderate (registration fees, accounting) |

| Investor Appeal | High (attracts investors) | Moderate (less familiar to investors) |

| Insolvency Risks | Directors must avoid wrongful trading | Partners must avoid wrongful trading |

Limited Liability and Insolvency in the UK

While limited liability is there to stop shareholders and partners from being personally responsible for business debts, it does not provide immunity from insolvency-related legal duties. Directors and partners must, therefore, act in the best interests of creditors when financial difficulties arise if they want to avoid personal liability.

If a business were to become insolvent, its directors would have a legal duty to:

- Immediately cease trading if the company is no longer able to pay its debts.

- Avoid wrongful trading. Meaning the business cannot continue to operate in any guise once insolvency has become unavoidable.

- Cooperate with a licensed insolvency practitioner.

Even with limited liability, directors of an insolvent company may still be held personally liable in the event of wrongful or fraudulent trading, personal guarantees being made to secure loans or credit, or misuse of company funds.

In order to minimise their risk of personal liability, directors should seek immediate professional insolvency advice once the situation has become difficult to manage, always keep accurate financial records, and avoid using personal finances to cover business debts.

Common Misconceptions About Limited Liability

Despite its widespread usage, limited liability is an often misunderstood term in business. Here are some of the most common misconceptions surrounding limited liability:

- Directors are Always Protected From Personal Liability: The reality of personal liability is that, if directors are found to have engaged in wrongful or fraudulent trading, they can still be held personally liable.

- Limited Liability = No Financial Risk: While personal assets are protected, poor business decisions will still result in financial losses being incurred by investors and shareholders.

Understanding these misconceptions can help business owners make better decisions about their business structure. For more information about limited liability and if it is ideal for your situation, or to learn more about how the Inquesta Insolvency team can help you, get in touch today.

“Many of the directors we work with at Inquesta will have signed a personal guarantee at some point — usually for things like commercial leases or bank overdrafts. The problem stems from when they forget they ever did it and, when the company gets in trouble, limited liability suddenly means nothing and pressure corrects. “

Steven Wiseglass, Director | Licensed Insolvency Practitioner

Business Support You Can Trust

As outlined, while it can be an excellent framework for a company to truly thrive, there are both advantages and disadvantages of limited liability.

For the insolvency team at Inquesta, understanding all of these intricacies enables us to provide astute, all-encompassing guidance to any of our clients looking for advice.

As you weigh the advantages and disadvantages of limited liability against each other, it’s important to remember that every business in the United Kingdom, Europe, and the world is unique. There is no one-size-fits-all solution to success.

Being a successful business owner requires you to not only seize any opportunities that may arise themselves, but also be conscious of any associated risks.

By seeking out expert advice from trusted experts such as the team at Inquesta, you can equip yourself with all the necessary knowledge to help you make more informed decisions that can shape your future, ensure you maintain control, and keep your profit margins healthy.

For more information about limited liability and if it is ideal for your situation, or to learn more about how the Inquesta Insolvency team can help you, get in touch today.

[/fusion_text][/fusion_builder_column][/fusion_builder_row][/fusion_builder_container]

💡 From an Expert Insolvency Practitioner

Steven Wiseglass

Director | Licensed Insolvency Practitioner

Founder, Inquesta | 10+ years in practice | Fellow of R3 | Member, R3 North West Committee

“Falling foul of wrongful trading rules can get directors into serious trouble, and it’s almost always about timing. Here’s what often catches people out: there’s no clear line that says “your company went insolvent on X date at X time”. It’s a judgement call. I’ve seen directors who have continued trading for months thinking they could turn things around, only to find out later that the liquidator appointed has decided that they were already insolvent. At that point, every penny spent, salary drawn, supplier and wage paid, can all be scrutinised. The argument will always be “I thought we would recover”, but if the writing was on the wall, personal liability can kick in.“