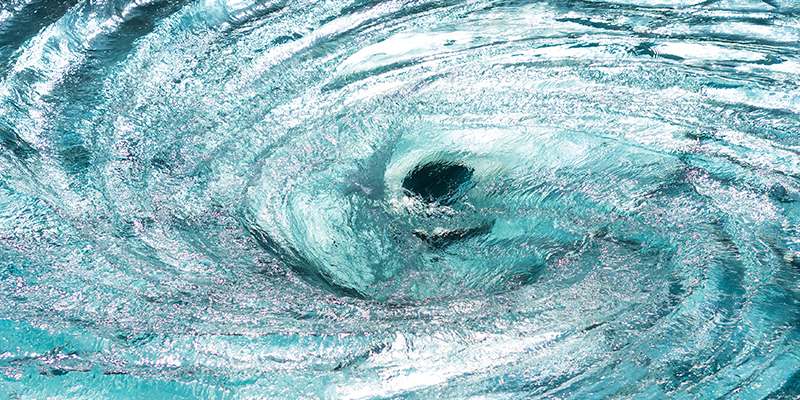

What may start as a short-term favour to yourself — borrowing money from your own company to cover a cash flow gap — can rapidly transform into a financial nightmare. An overdrawn director’s loan account isn’t just a minor accounting foible, it’s a potential ticking time bomb with consequences that can extend far beyond simple tax penalties.

The statistics on the subject are stark: overdrawn director’s loan accounts are estimated to feature in around 75-80% of all business insolvency cases, transforming what some will initially have viewed as a simple and harmless internal arrangement into a potentially devastating personal liability. These aren’t abstract risks — they represent tangible threats to your assets, your home, and your ability to work again as a director.

If you currently have an overdrawn director loan account, every day you delay concerted action, the window for proactive measures narrows, and your exposure to potentially catastrophic personal liability increases. In this blog, we’ll explain how overdrawn director’s loan accounts usually occur, the tax traps and legal dangers you may face, and the practical steps you can implement today to protect both your business and personal finances.

What Is an Overdrawn Director’s Loan Account?

An overdrawn director’s loan account occurs when you’ve withdrawn more money from the business than you’ve contributed to it. There are some exclusions from this, including:

- Legitimate salary paid.

- Properly declared dividends.

- Reimbursement for business expenses.

It’s critical to remember that your company exists as a totally distinct legal entity from you personally. This degree of separation is what makes you liable should HMRC or liquidators become involved.

The moment your company faces difficulties, your “informal arrangement” will transform into a weapon that creditors and authorities will use to pursue you.

How Directors Fall Into the Overdrawn Trap

Most overdrawn loan accounts develop innocently through a series of seemingly harmless decisions that accumulate into more serious problems, such as:

- Personal Expenses: Utilising company funds for personal bills, family expenses, or treating business funds as an extension of personal finances. What starts as “I’ll pay it back next week” can turn into months of undocumented and poorly tracked borrowing.

- Dividend Miscalculation: Taking money from the business in anticipation of future profits that never materialise. When economic downturn hits or unexpected costs arise, any planned or hoped-for profits will have vanished — leaving you with unauthorised borrowing instead of the legitimate dividend payments you anticipated.

- Poor Boundaries: If a director operates with a “what’s mine is mine” mindset, without considering the necessary legal separation between personal and company assets.

- Poor Record-Keeping: Multiple small transactions, if allowed to accumulate unnoticed until the end of the financial year, can result in a significant overdraft.

The warning signs of overdrawn director’s loan accounts will often appear subtle initially. Many people will only discover the true extent of their predicament during year-end procedures. However, by this point expensive tax charges may already be unavoidable and personal liability exposure will have reached a dangerous level.

Section 455 Tax Explained: Penalties for Overdrawn Director’s Loans

S455 tax represents HMRC’s nuclear option for punishing directors who treat company funds as personal resources. When a director’s loan over £10,000 remains outstanding nine months after your company’s year-end, section 455 penalties can kick-in, to devastating effect.

The 32.5% Penalty That Kills Companies

The current s455 tax rate stands at 32.5% of your outstanding loan balance. This amount is deliberately set high in order to match higher-rate income tax levels. The penalty is not intended to be a slap-on-the-wrist, it’s designed to hurt financially.

How it works in principle: If you borrowed £15,000 in March and your year-ended in December, by the following September, your company will face a tax bill of £4,875. This charge will apply no matter what — regardless of whether the company is profitable or struggling to survive.

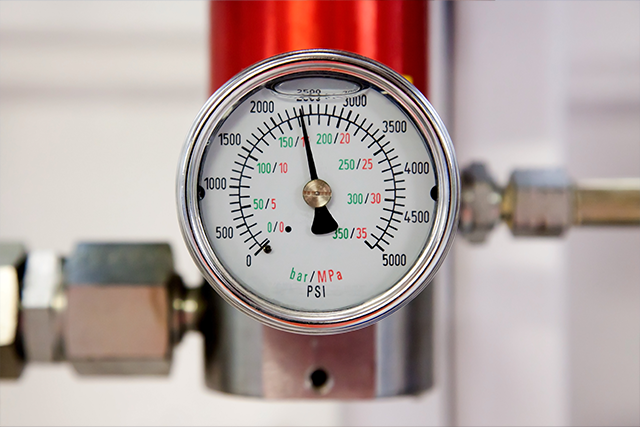

The Cash Flow Death Spiral

S455 tax can become really crippling when cash flow comes into the equation: whilst technically recoverable, the usual process to do so can take some time. This creates a serious cash flow shortage that could destroy a struggling business.

With the S455 tax, your company is required to pay what is owed immediately when due. You can reclaim this money. However, the period to reclaim is nine months after the accounting period in which you repaid the loan — which will often be around 18-24 months later.

If you are facing financial pressures, this forced “interest-free loan to HMRC” can be the death-knell that triggers insolvency. The irony of this is that the companies most likely to have overdrawn director’s current accounts — those facing cash flow issues already — are precisely the companies least able to afford having significant sums locked away with HMRC for long-periods.

If your accounting period ends soon and you have an overdrawn director’s loan account, you likely only have weeks to avoid these charges. Contact a specialist immediately for professional intervention.

Anti-Avoidance Rules: HMRC’s Legal Minefield

Recognising that some directors might do whatever they can to sidestep the S455 charges through strategic payment timing, HMRC has deployed sophisticated anti-avoidance rules to close this potential loophole. These rules can even trap unwary directors in a worse position than if they had accepted the original charges in the first place.

The 30-Day Rule

HMRC’s 30-day rule effectively cancels any loan repayments if you re-borrow £5,000 or more within 30 days. This treats your initial repayment as ineffective, as the amount was immediately re-borrowed.

Therefore, if you repaid £10,000 in October to clear your overdrawn director’s loan account, then re-borrow £7,000 two weeks later, only £3,000 of your repayment will actually count, and S4555 tax rates apply to whatever has been re-borrowed.

The “Intentions and Arrangements” Trap

Potentially even more damaging is the rule that targets a director’s intentions when making repayments. If your director’s loan account overdrawn amount exceeds £15,000 and you have an arrangement (or intention) to re-borrow £5,000 or more when this repayment is made, s455 charges will apply — regardless of the timing.

The trap in practice: If you were to repay a £20,000 loan in September, but board meetings from June show that discussions took place with regards to borrowing a further £15,000, HMRC will treat this September repayment as ineffective up to £15,000 as the agreement predates when you made the repayment — even though the new borrowing didn’t take place until months later.

To prove that a repayment was only intended to be temporary (i.e., you repaid the loan with the plan to re-borrow it later), HMRC can look at board meeting minutes, emails, and other communications.

Personal Liability: When Everything Collapses

The most devastating consequences of overdrawn director’s loan accounts take place when overdrawn companies face insolvency. This is because what may have started as an internal arrangement will very quickly become an external issue — a debt that liquidators will be required to pursue on behalf of creditors.

Misfeasance Claims: Personal Financial Destruction

Liquidators will routinely examine the conduct of director’s, and frequently initiate misfeasance proceedings should they find any issues. Misfeasance occurs when you’ve borrowed money from your company when it was already struggling financially, and can lead to severe scrutiny and consequences.

Successful misfeasance claims against a director create personal liability that could exceed your total assets — forcing personal bankruptcy.

Director Disqualification: Career Death Sentence

Substantially overdrawn director’s loan accounts paired with the closure of the company in question will almost inevitably trigger director disqualification proceedings. Directors who are seen to have prioritised personal withdrawals over protecting company creditors are deemed as unfit for their position.

Disqualification carries career-altering consequences:

- Banning from acting as a company director for between 2-15 years.

- The disqualification becomes public record — creating permanent reputation damage.

- Personal liability will be accrued for all business debts if you continue to act whilst disqualified.

Emergency Strategies: Your Escape Routes

When facing an overdrawn director’s loan account with approaching deadlines or company difficulties, understanding your resolution options becomes critical for minimising damage and protecting your personal position:

- Dividend Declarations: Declaring dividends without withdrawing cash and crediting the amount directly against your outstanding loan balance. This approach offers immediate relief from S455 charges without requiring personal funds for repayment. However, it’s important to remember that dividends can only be paid from available profits.

- Salary Increase: Increasing your salary, or declaring bonuses, will generate funds for loan repayment whilst avoiding s455 charges. The trade-off here is that it will create an immediate tax consequence that could prove substantial.

- Formal Loan Agreements: Establishing proper documentation of loans, with commercial interest rates and realistic repayment terms, will provide protection against scrutiny. The current interest rate for director’s loans is 2.25% per annum.

For more information about writing off director’s loan accounts, check out our dedicated blog for expert insights.

Prevention: Your Best Defence

Given the potentially catastrophic consequences of overdrawn director’s loan accounts, prevention represents by far your most favourable strategy. Tips to prevent overdrawn director’s loan accounts include:

- Financial Separation: Never utilise company accounts for personal expenses without proper documentation and authorisation, regardless of the amount involved. Even small transactions can accumulate over time.

- Monthly Monitoring: Regularly review your director’s current account’s overdrawn position, to help you identify problems before the situation is allowed to become critical.

- Seek Guidance: Establish a relationship with a qualified accountant to ensure you remain in the clear when it comes to your director’s loan accounts. Professional fees will represent a minor investment compared to the potential liability.

- Thorough Documentation: Any and all financial transactions between yourself and the company require clear documentation and proper authorisation before they can be made.

Your Financial Survival Depends on Immediate Action

An overdrawn director’s loan account represents an immediate and active threat that will only grow more dangerous with each passing day. Whilst immediate tax consequences are severe, long-term personal liability risks during insolvency and company closure have the potential to destroy both your financial future and your professional reputation — harming your earning potential for years to come.

When your director’s current account is overdrawn, time is your most critical resource. Every day without strategic action only increases potential liabilities, reduces your available options, and moves you closer to the brink.

What You Need Right Now:

- Immediate professional assessment of your loan account position and the potential s455 charges you can expect to face.

- Strategic and co-ordinated planning to minimise tax charges and personal liability while keeping company doors open.

- Assistance from an expert to ensure you are adhering to all current regulations.

- Insolvency support should your company be facing financial issues.

Don’t let an overdrawn director’s loan account destroy everything you’ve built. Professional intervention protects you from devastating personal liability, director disqualification proceedings, bankruptcy and asset loss, and permanent reputation damage.

Contact Inquesta’s specialist insolvency and company recovery experts today. Delaying will only cut your options and make resolution more costly (if possible at all). The sooner you reach out, the better your options and the better the outcome you can expect.

Professional help is there for you, but only if you act immediately — before the window closes permanently. Get in touch today.